The Jumpstart North Philly West™ Loan Program is available through Jumpstart Philly and provides loans for the acquisition and construction of residential and mixed use properties citywide. Our financing program has competitive rates and can be a source of funding where traditional loans might be difficult to acquire. The Loan Program is available to both experienced and novice developers, however novice developers are strongly encouraged to first participate in the Training Program.

Eligibility

-

Financing for projects anywhere in the City of Philadelphia

-

Jumpstart Philly is now available Citywide!

-

-

Open to Anyone

-

Jumpstart Training Program Graduates within the City & Norristown receive a 1/2% interest rate discount

-

-

Credit Report & Proof of Funds

-

For buy & hold a minimum score of 680 required for all borrowers. No minimum score for buy & sell.

-

Proof of Funds needed to ensure borrowers have funds needed to complete the project.

-

-

Focus on Residential properties

-

Mixed-use projects considered for more experienced developers (must have residential component)

-

Property needs to be vacant (with very few exceptions)

-

Loans are not for single family owner-occupied properties

-

Loan Details*

-

Loans up to 85% of the total cost of acquisition and construction. Borrower provides the remaining 15% of the total project cost at settlement.

-

For mixed-use properties, we will consider 80% LTC

-

For properties owned free & clear, we will consider 100% construction-only financing

-

-

Maximum loan per property: $350,000 for one unit, increase by $50,000 for each additional unit

-

Maximum amount outstanding for a borrower is $750,000

-

Funding advanced as work is completed. No construction funds disbursed at settlement. Borrowers need funds to get work started.

Terms*

-

Interest-only loans at the following fixed rates:

-

8.98% – Jumpstart graduate rate (for graduates of a Philadelphia or Norristown Jumpstart Training Program)

-

9.48% – Non-graduate rate

-

-

12 month term – borrowers purchase, renovate, and either sell or refinance within one year. (Up to two 3 month extensions available)

-

Additional Requirements:

-

1st Lien placed on property

-

Lender’s title insurance

-

Personal guarantee(s)

-

Satisfactory credit (for Buy & Hold projects, minimum credit score of 680 for all borrowers)

-

Interest-only monthly payments due after final draw

-

-

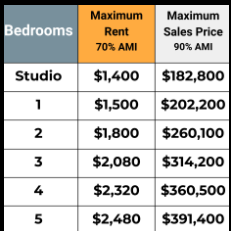

Affordability restrictions apply: See chart for rent/sales restrictions.

-

Rental properties at 70% or less AMI (Area Median Income)

-

For-sale properties at 90% or less AMI (Area Median Income)

-

Cost Details*

-

$225 Site Visit Fee – due prior to initial site visit (non-refundable)

-

$1,275 Loan Commitment Fee – due upon loan approval (non-refundable, but transferrable to another property if loan does not close)

-

$275 Legal fees – Rolled into the loan, additional fee if more than 2 borrowers/members

-

2% Loan Fee – Rolled into the loan

Potential Fees:

-

2% Extension Fee – loans exceeding the initial term may receive up to two 3 month extensions at 2% of the total loan amount.

-

$250 Additional Inspection Fee – if borrower requires more than 4 draw inspections

When to Apply?

Loan applications are project specific. You’ll submit a loan application once you’ve identified a property.

You can apply prior to making an offer on the property, after the property is under agreement, OR if you own the property free & clear.

How to Apply?

Online Loan Application

-

Borrower Information

-

Property Information

-

Project Information (exit strategy, end use, etc…)

-

Estimated Project Numbers

-

Basic Scope of Work

-

Contractor Information (if applicable)

-

Addresses for Comps (within 6 months and 1/2 mile)

- Make sure to name Jumpstart North Philly West on the loan application as the person who referred you to the loan program.

After receiving your completed online application, we will review and send you a pre-generated proforma using the information from your application. If you would prefer, complete the proforma ahead of time and attach to your application.

*Terms subject to change